That $1.3 trillion came and went in one month, and people didn’t notice – it’s amazing.

By Wolf Richter for WOLF STREET.

This week was marked by a continued sell-off in technology and the collapse of a “cycle” that has been highly recommended for small caps: the S&P 500 is down 2.0%, the Nasdaq composite is down 3.6%, the Nasdaq 100 is down 4.0%, and Magnificent. 7 is down 4.7%.

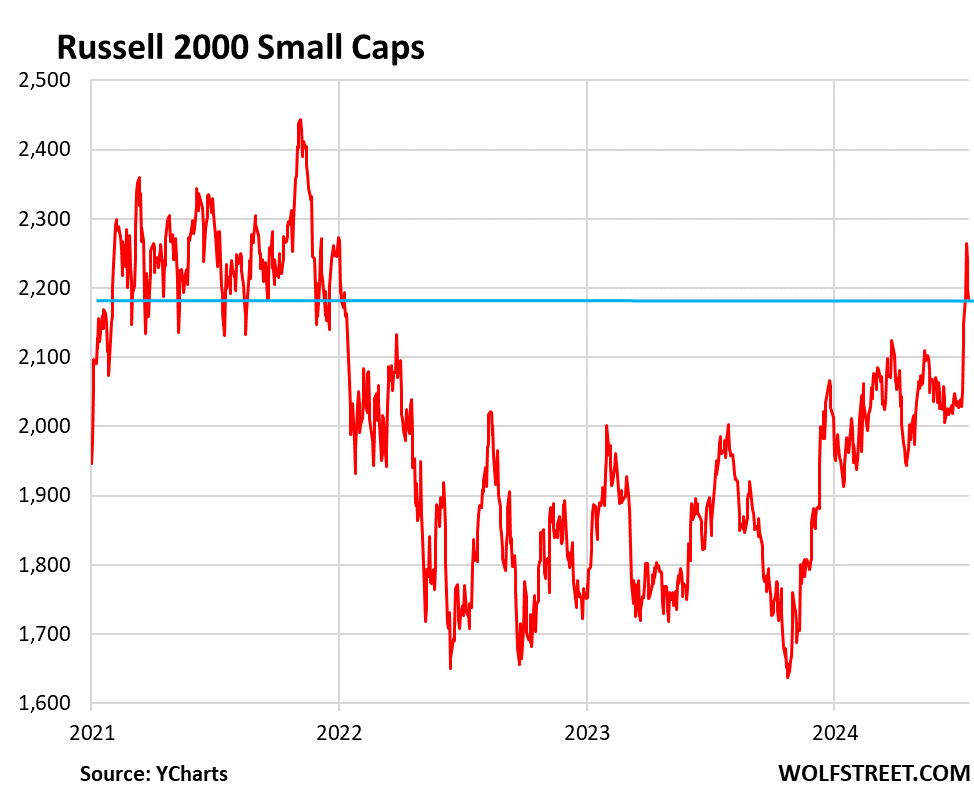

But the Russell 2000, which tracks about 2,000 stocks, rose 5.3% in the first two days of the week, as part of a “rotation” in small stocks, and was lowered by 3.5% on the remaining three days of the week. , and ended the week up 1.7%, returning to where it was in February 2021.

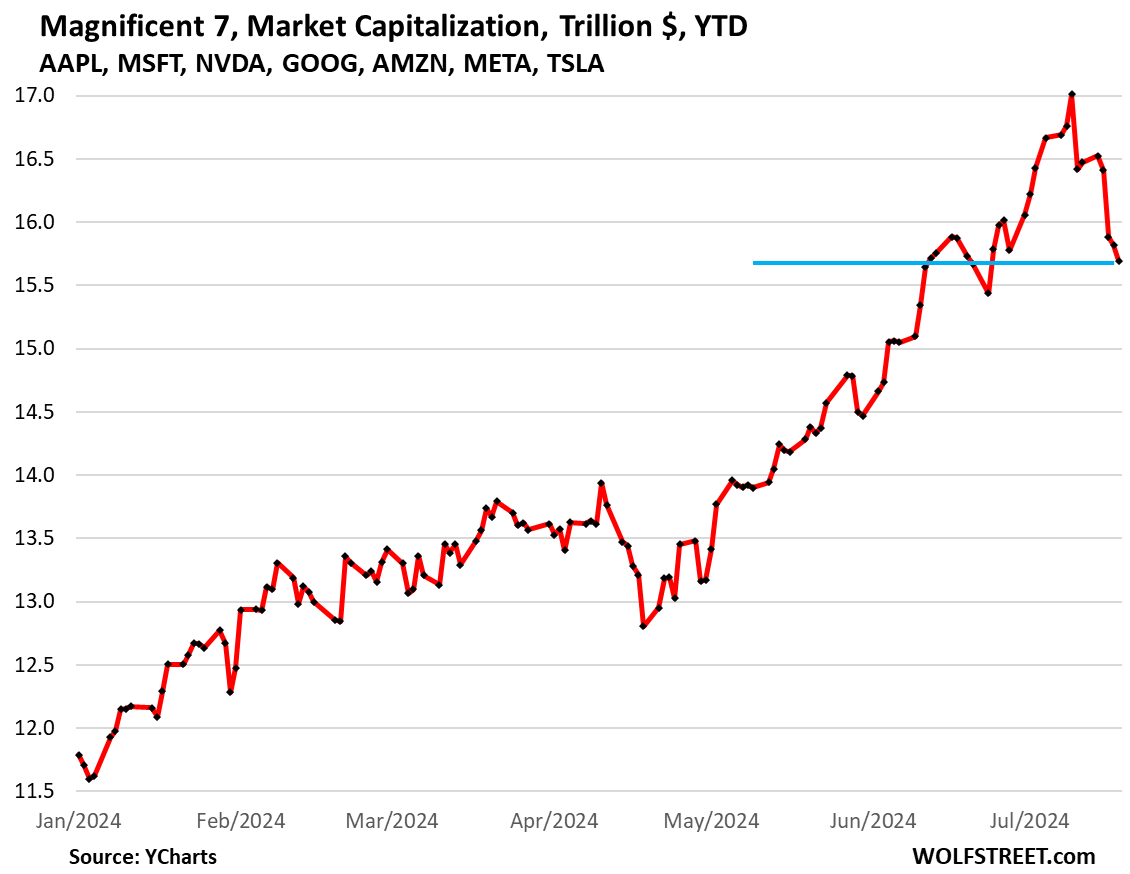

Mother 7 lost another 113 billion dollars in the market on Friday, bringing the total decrease from the peak of July 10 to $ 1.32 trillion (-7.7%). That $1.32 trillion came and went in about a month, spread over just seven stocks, and people didn’t notice – it’s amazing when you think about it. It used to be serious money.

Their combined market capitalization is now down to $15.69 trillion, from over $17 trillion on July 10. Mag 7 is now back where it was the first time on June 13. This $ 1.32 trillion exceeded the decline of the dollar in April (-$1.13 trillion). ). But the 7.7% decline still falls short of April’s 8.1% decline.

Individual stock declines in Mag 7, from the July 10 peak (Nvidia jumped on Thursday but let it go again on Friday):

- apple [AAPL]: -3.6% (-$129 billion)

- Microsoft [MSFT]: -6.3% (-$217 billion)

- Alphabet [GOOG]: -6.9% (-$164 billion)

- Amazon [AMZN]: -8.3% (-$173 billion)

- Tesla [TSLA]: -9.2% (-$78 billion)

- Measure [META]: -10.8% (-$146 billion)

- Nvidia [NVDA]: -12,3% (-$410 billion).

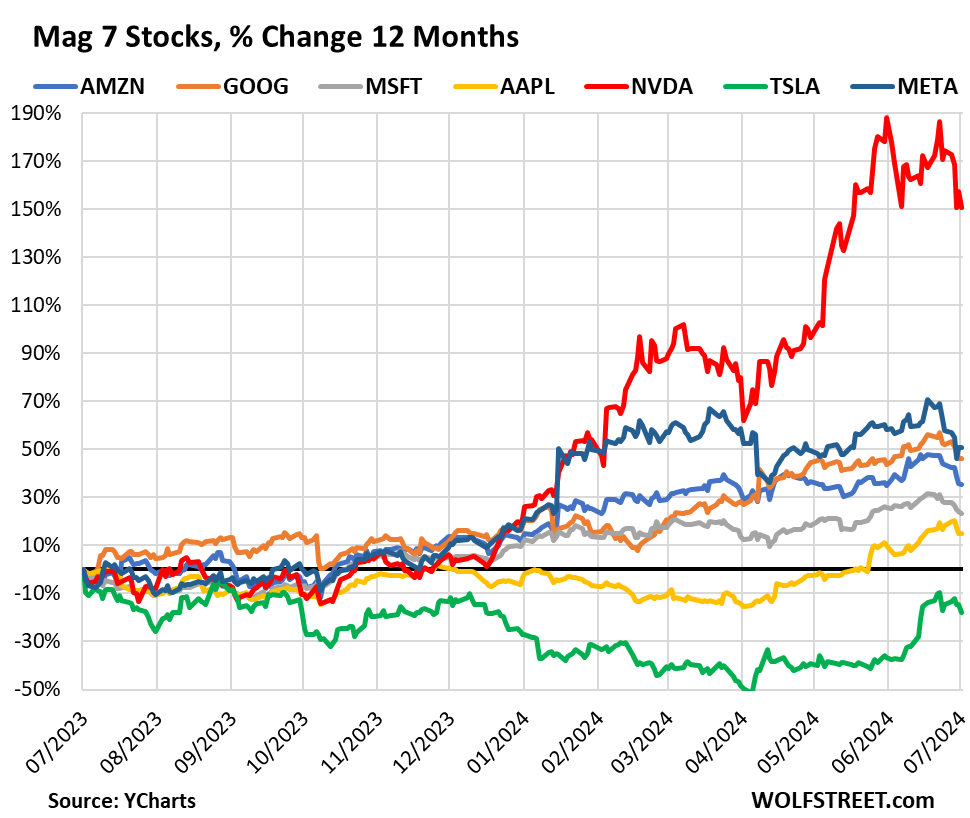

In the last 12 months, in percentage terms, the two Mag 7 outs:

- Nvidia, which is still 150% in 12 months, despite the recent decline (red line in the chart below)

- Tesla, which is down 18% in 12 months, and down 42% from all time in February 2021 (green).

The 12-month performance of the remaining 5 Mags is dwarfed by Nvidia’s 150% profit, although it is still steep despite the recent decline:

- Meta: +50.9%

- Letters: + 46.1%

- Amazon: +35.3%

- Microsoft: +23.1%

- Apple: +15.0%.

Small stocks it continued on Wednesday, July 17, after their sudden brilliance in which the entire market was supposed to “wash” on them, or whatever.

The Russell 2000 was down 11.5% in the five trading days between July 9 and July 16. On Wednesday, the index began to decline, and on Friday, it closed 3.5% from Tuesday’s high. But due to a spike of 5.3% in the first two days of the week, the index was still 1.7% for the week.

The Russell 2000, at 2,184, is back to where it was in February 2021. That kind of suddenness and decline doesn’t ease our worries, of course.

Nasdaq 100 indexwhich tracks the 100 largest non-financial stocks on the Nasdaq and is dominated by technology and social media giants, is down 4.0% for the week and down 5.6% in from the peak of July 10.

So far, the index has risen by 16%, despite two sales. The first in April ended with a decrease of 6.2%.

Since the start of 2021, the index is up 51.5%, with a large gap in the middle. It’s up 88% from its trough in December 2022. That dramatic move to these dizzying highs doesn’t ease our worries at all.

S&P 500 has just begun to show the first impact of the technological drama. Sales have been weak so far. The index is down 2% for the week and is down 2.9% from Tuesday’s high.

Since the beginning of 2021, the index has risen by 47%. Since the bottom of the boat in October 2022, the index is up 53%. These are the biggest immediate gains on top of already high estimates, and the downside so far is nothing:

Enjoy reading WOLF STREET and want to support it? You can give. I really appreciate it. Click on the barrel of beer and iced tea to find out:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

#Stocks #Short #Rotation #Spike #Magnificent #lost #trillion #Days