The Fed is likely to start cutting interest rates in the coming months, with good reason.

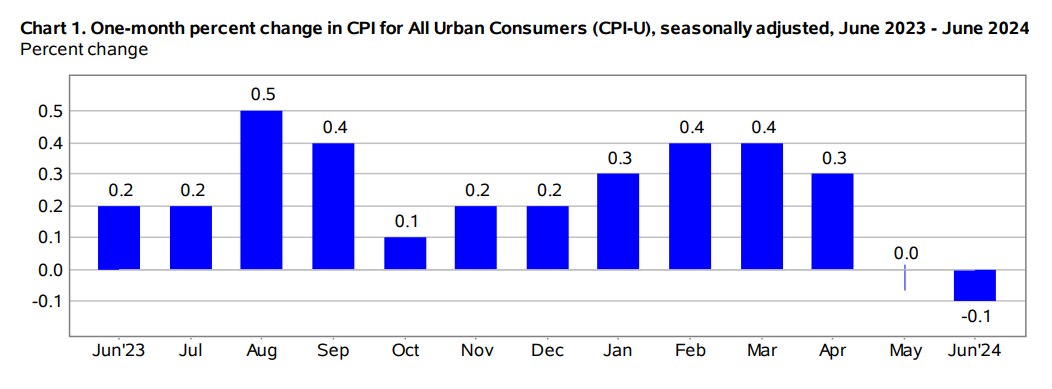

Last week it sounded like a victory against high inflation:

Now we have not had an increase in prices to the general inflation rate for two months.1

Some experts still aren’t convinced it’s time to take the win just yet.

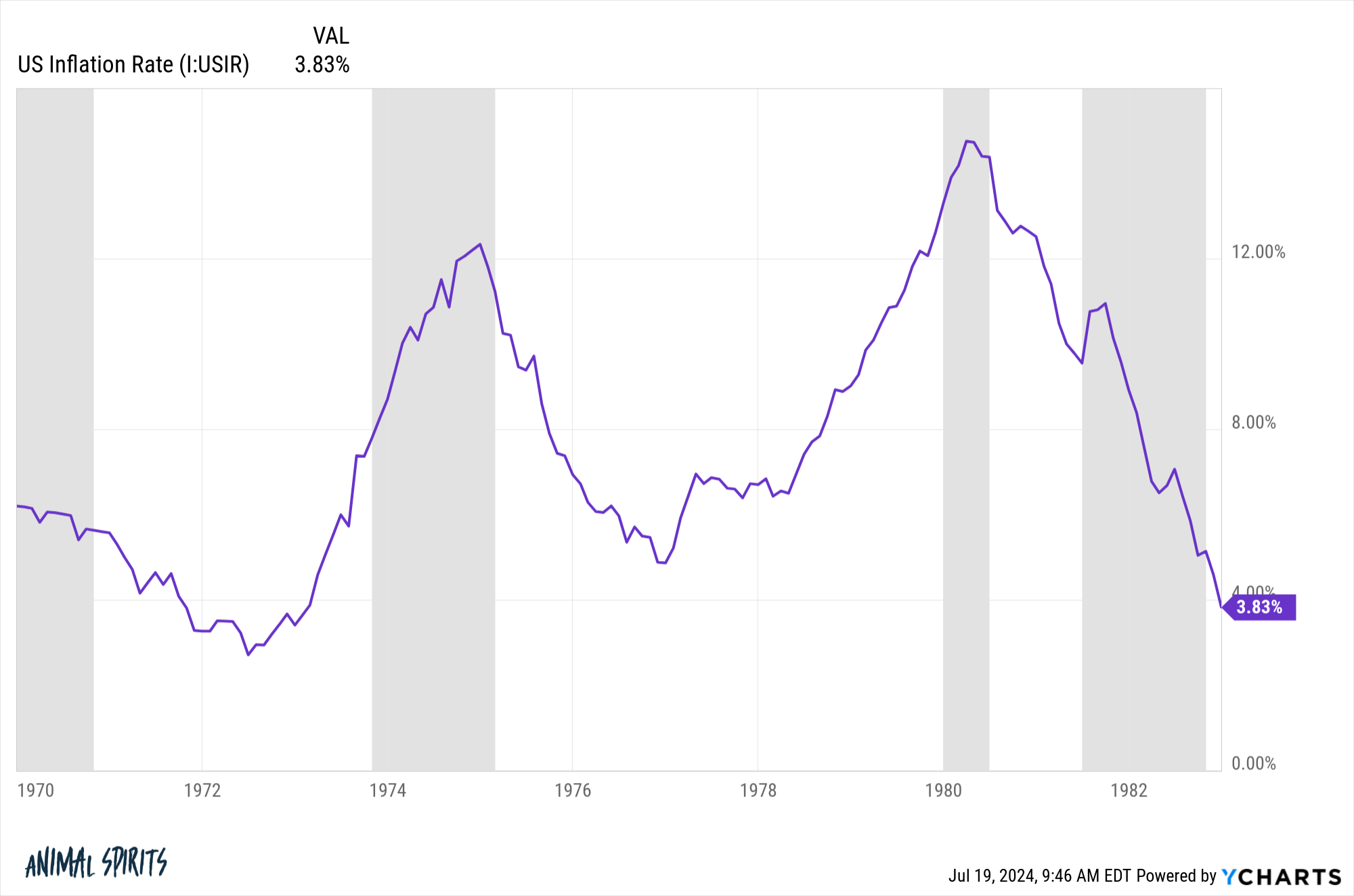

What about the 1970s?

There was a spike in inflation at the beginning of the decade, it fell, then accelerated again:

There are many differences between this economic period and the 1970s. People who want to use the analogy of the 1970s always fail to mention that inflation fell in the middle of the decade because of a severe recession. The stock market experienced a major crash in 1973-74.

This time we brought down inflation without recession.

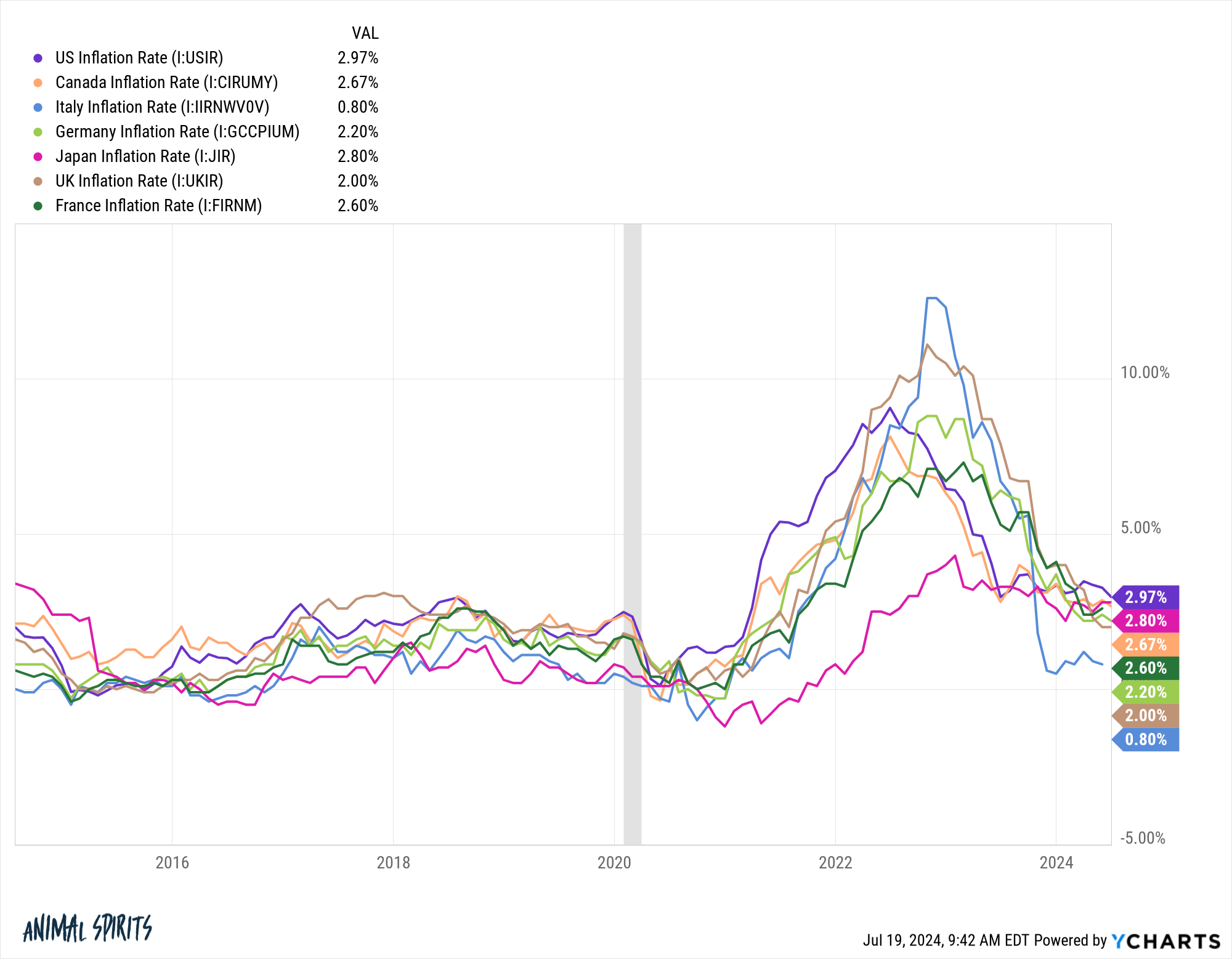

Moreover, inflation was global in nature and fell at the same time across developed countries:

Inflation is in a better place than it was 18-24 months ago.

However, some people want to wait for the coast to be clear to ensure that this period of inflation is over.

That’s right.

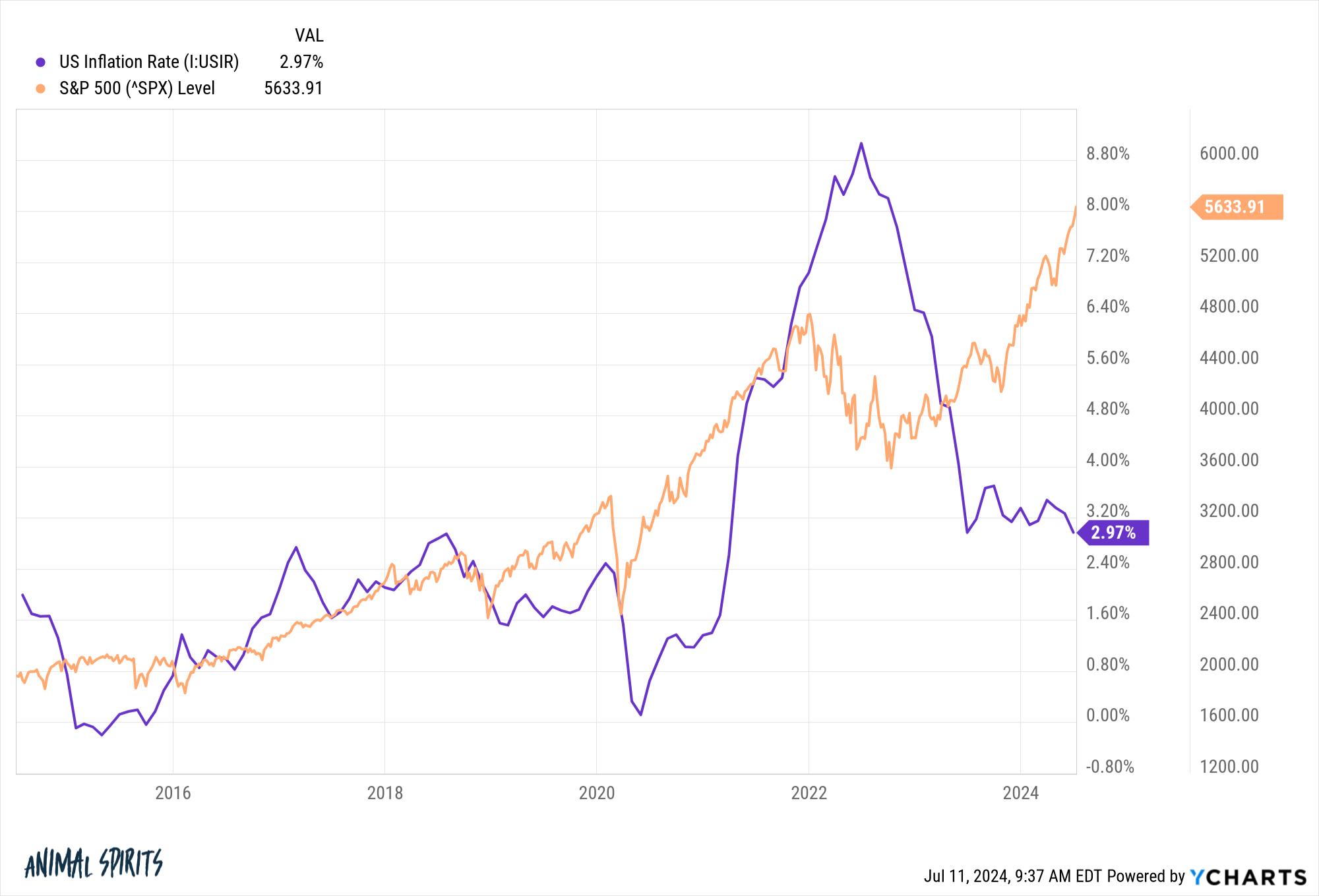

The stock market is not waiting for the coast to be clear.

The S&P 500 fell as inflation topped 8% late in the fall of 2022:

Inflation had come down slightly from the peak but if you go back and look at the headlines in October 2022, nobody thought the big pain was over. The recession was the consensus forecast:

Stagflation. It is high for a long time. Pain in the front. Things looked bleak.

The S&P 500 is up more than 50% since inflation topped 9% in June 2022.

Look, it’s always easier to talk about stock markets with the benefit of hindsight. No one knows how bad things will get when we live in the middle of a bad recession.

But the point here is that buying opportunities in a bear market always seem clear and easy after the fact, but never in real time.

Economists can wait for the coast to clear before taking a victory lap on inflation and reducing prices.

The stock market does not stand still.

There is no sign when the coast is clear. No one rings the bell downstairs to let everyone know it’s time to buy. The stock market doesn’t wait for good news to happen; yes anticipate (sometimes right, sometimes wrong).

You can’t wait until the coast is clear to invest during a bear market. The bear market will be over before the economic data turns positive.

Michael and I talked inflation, the stock market, Kevin Bacon and more in this week’s Animal Spirits video:

Subscribe to The Compound so you don’t miss an episode.

Further reading:

Why Today’s Inflation Is Not a Repeat of the 1970s

So here’s what I’ve been reading lately:

Books:

1Inflation never “does” in the sense that prices always go up. It is rising at a reasonable rate.

This content, which contains opinions related to security and/or information, is provided for informational purposes only and should not be relied upon in any way as professional advice, or endorsement of practices, products or any services. There can be no guarantee or warranty that the opinions expressed herein will be applicable for particular facts or circumstances, and should not be relied upon in any way. You should consult your own advisors regarding legal, business, tax and other matters related to any investment.

Comments on this “post” (including any related blogs, podcasts, videos, and social media) reflect the views, opinions, and reviews of Ritholtz Wealth Management employees who provide views are, and should not be construed as, the views of Ritholtz Wealth. Management LLC. or its various affiliates or as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to any assets or digital assets, or performance data, are for informational purposes only, and do not constitute an investment recommendation or offer to provide advisory services regarding investment. The charts and graphs provided herein are for informational purposes only and should not be relied upon in making any investment decision. Past performance is not indicative of future results. The content only refers to the date shown. Any values, estimates, projections, expectations, expectations, and/or opinions expressed in these articles are subject to change without notice and may differ or contradict the opinions expressed by others.

Compound Media, Inc., a subsidiary of Ritholtz Wealth Management, receives payment from various agencies for advertisements on affiliate podcasts, blogs and emails. The inclusion of such advertisements does not imply or imply endorsement, support or encouragement thereof, or any association with it, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Financial investments involve the risk of loss. For additional advertising disclaimers see here: https://www.ritholzwealth.com/advertising-disclaimers

Please see the disclosures here.

#Waiting #Coast #Clear #Inflation #Wealth #Common #Sense